The crypto space is truly a case of "some rejoice while others mourn"! Some coins are being frantically bought by institutions, some have been handed a death sentence, and others are leaving short sellers crying in the bathroom — this article breaks down the trading logic of the hot coins clearly. Save it now!

BTC/ETH: Stuck at Key Levels, Only a Breakout Brings Opportunity!

BTC: The $92k-$94k Line is a Matter of Life and Death

Big Brother Bitcoin is back in the $92,000-$94,000 resistance zone! Now it's up to the bulls: if they can break through this range, the next target is directly aiming for $100,000; if they can't break through, it will likely fall back below $90,000. This back-and-forth is so tedious~

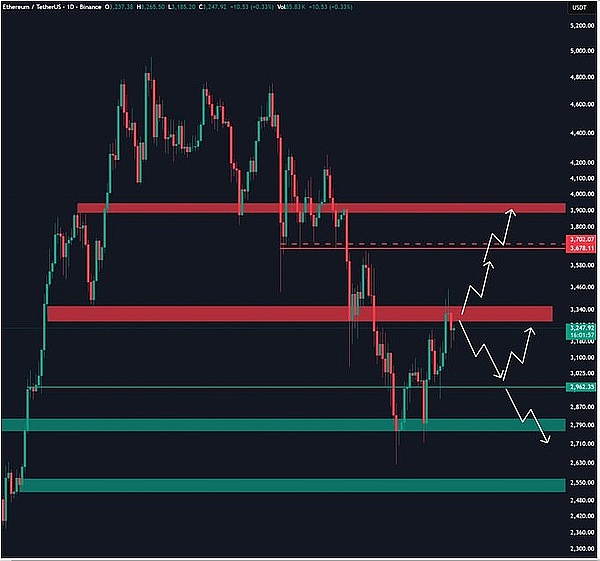

ETH: $3400 Determines the Direction

Ethereum is charging at the resistance level again! The key is to see if the daily chart can hold firmly above $3400: if it holds, it will run towards $3700-$3800; if it fails to hold, it will have to go back and test the $3000 support. Don't blindly chase the high, wait for a clear direction before acting!

SOL: The 'Potential Stock' Frenziedly Bought by Institutions, Buying a Little Daily is Worth It!

If we're talking about the altcoin most favored by institutions right now, SOL definitely takes first place! Its fund flows are too strong:

It's been almost two months since the ETF approval, and no matter how much the market falls, funds have been quietly adding to their positions, completely unfazed;

Coinbase directly added DEX trading functionality for the Solana ecosystem in its official App, essentially opening a "green channel" for SOL;

From JPMorgan to Nasdaq, traditional finance bigwigs are building on the Solana chain, making the ecosystem increasingly stable!

Remember: follow the market funds, don't be swayed by various bull/bear news! SOL is currently a key target for institutional布局 (layout). Buy a little bit daily and accumulate slowly, making money is just a matter of time~

Terra Ecosystem (LUNA/LUNC/USTC): Game Over! Founder Sentenced, Paying for the $40 Billion Loss

The Terra ecosystem is completely finished! Founder Do Kwon has been sentenced to 15 years in prison. The "crash disaster" he created back then directly evaporated $40 billion and triggered a chain reaction: FTX collapsed next, trust in algorithmic stablecoins completely crumbled, and the crypto market went into winter~

LUNA, LUNC, and USTC are now completely battered by the fall. This isn't a simple pullback; it's the complete landing of negative news. There's little chance of a comeback later. Don't even think about buying the dip, don't touch them!

ZEC: Stubborn Shorts Get Trapped, Whales Profit by 'Sideways Movement'!

ZEC short sellers have had it rough lately! Many opened short positions hoping to make a profit, but ended up getting trapped deeper, and some fearless ones kept charging in, being extremely stubborn~

Especially the "top short seller" with the largest position, who was already profitable but didn't close the position, is now back in the red! Although they reduced their position a bit when the price dropped to the 300s, most of the position is still there. Fortunately, the whale has sufficient margin, with a liquidation point at $1057U, so they are safe for now, but the后续 (follow-up) is even more uncomfortable:

The whales have no intention of making big pumps or dumps; they just maintain the current price sideways, making money daily by collecting funding fees! Even though it's collected only every 8 hours, the large position size means they earn a significant amount~ They can even use the collected funding fees to slowly pump the price, wearing down these short sellers!

So ZEC isn't impossible to short, the key is to know when to stop, take profits and run quickly when you have them, don't linger. Money in hand is real money!

Summary: Wait for a breakout before acting on BTC/ETH, SOL can be accumulated daily with small positions, blacklist the Terra ecosystem entirely, don't be greedy when shorting ZEC.